Nassim Nicholas Taleb

Nassim Nicholas Taleb (Scholar Investor) - Effective governance of small states (Dec 2023)

Nesim Taleb's insights on uncertainty management include embracing disorder and avoiding excessive stability, focusing on systemic resilience, and categorizing uncertainty into "mediocre-stan" and "extreme-stan." Taleb emphasizes the importance of anti-fragility in systems, whereby they thrive in the face of random events and errors.

Nassim Nicholas Taleb (Scholar Investor) - How the Social Fabric Works (Dec 2023)

Nassim Nicholas Taleb's insights highlight the fragility of nations with low variability, likening economic stability to a steady heart rate—both indicators of potential collapse. AI's utility is akin to a calculator, enhancing tasks but lacking original thought, while cultural unity and social fabric are crucial for societal well-being.

Nassim Nicholas Taleb (Scholar Investor) - Self-Education and Doing the Math (Nov 2023)

Lebanese history and modern thought are rich tapestries of ideas influenced by historical events, cultural dynamics, and philosophical insights. Education should balance practical skills with preserving cultural values, while learning by doing is more effective than theory-based education.

Nassim Nicholas Taleb (Scholar Investor) - Connectivity, Global Fragility, and the Added Danger of AI (Oct 2023)

Connectivity enhances efficiency but makes systems more prone to catastrophic events. Anti-fragility promotes resilience by adapting to and benefiting from stressors.

Nassim Nicholas Taleb (Scholar Investor) - How Traders Make Billions in The New Age of Crisis (Sep 2023)

In an unpredictable world, Nassim Taleb emphasizes risk management and intellectual rigor, while Scott Patterson explores the role of hedge funds in financial markets. Their insights provide guidance for navigating modern complexities and preparing for future uncertainties.

Nassim Nicholas Taleb (Scholar Investor) - Stephen Wolfram visits RWRI 18 (Summer Workshop) (Jul 2023)

Language models like CHAI-3DP and ChatGPT transform technology into linguistic interfaces, but their accuracy is limited by the reliability of their training data. AI's linguistic capabilities can be enhanced by computation, enabling precise expressions and systematic idea development.

Nassim Nicholas Taleb (Scholar Investor) - Inflation, Global Financial Markets, & Crypto | Bloomberg Invest New York 2013 (Jun 2023)

Modern finance's foundations are flawed, leading to investment strategies vulnerable to volatility and tail events, as highlighted by Taleb and the COVID-19 pandemic. Central banks' drastic interest rate adjustments are ineffective in fixing underlying economic issues and may have unintended consequences.

Nassim Nicholas Taleb (Scholar Investor) - Markets, Interest Rates, Bubbles, Investing | Bloomberg (Jan 2023)

The 2008 financial crisis led to a tumor of illusory wealth and a mirage of billionaire wealth, while Nassim Taleb criticizes the current economic structure and advocates for tail risk hedging.

Nassim Nicholas Taleb (Scholar Investor) - Covid (Oct 2022)

Fat tail processes, characterized by extreme events occurring more frequently than expected, have profound implications for statistical analysis, decision-making, and social dynamics, challenging traditional models and requiring nuanced approaches.

Nassim Nicholas Taleb (Scholar Investor) - Nations, States, and Scale | EconTalk (Jul 2022)

The sizes and structures of nation-states profoundly impact their governance, resilience, and identity. Smaller states often fare better in governance, adaptability, and antifragility compared to larger ones, demonstrating advantages in accountability, decision-making, and efficiency.

Nassim Nicholas Taleb (Scholar Investor) - Formlabs' The Digital Factory conference in Boston (May 2022)

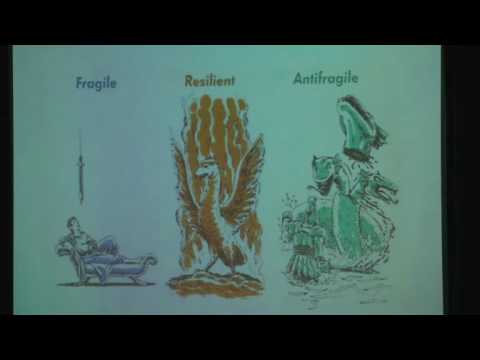

Nassim Nicholas Taleb emphasizes embracing uncertainty, variability, and stressors as a means to foster growth and adaptation in systems. Taleb's concepts of fragility and antifragility provide frameworks for assessing risk and understanding the role of stressors in promoting resilience and adaptability.

Nassim Nicholas Taleb (Scholar Investor) - Antifragile (Mar 2022)

Nassim Nicholas Taleb's concept of antifragility emphasizes the importance of embracing stressors and uncertainties as catalysts for growth and resilience, while Taleb's insights on fat-tailed variables and the nonlinearity of harm provide valuable frameworks for navigating a world marked by uncertainty and conflict.

Nassim Nicholas Taleb (Scholar Investor) - Antifragile (Mar 2022)

Understanding fragility and antifragility in complex systems, like the ongoing Ukraine crisis, provides valuable insights for navigating uncertainty and thriving amidst challenges. Embracing variability, fostering resilience, and seeking balance in the face of stressors can enhance adaptability and growth in the midst of challenges.

Nassim Nicholas Taleb (Scholar Investor) - MINI LECTURE 14 A First Course on Fragility, Convexity, and Antifragility (Nontechnical). (Jan 2022)

Nonlinearity is the core concept in understanding fragility and antifragility, where fragile systems deteriorate under stress while antifragile systems thrive. Understanding and leveraging nonlinearity is crucial for designing systems resilient to uncertainty and change.

Nassim Nicholas Taleb (Scholar Investor) - Brooklyn Quant Experience Lecture Series (Sep 2021)

Risk assessment should consider the domains of consequences and observation, as well as the value of paranoia and early action. Intergenerational reciprocity and scalable professions can help mitigate black swan events.

Nassim Nicholas Taleb (Scholar Investor) - World Health Network Daily Call (Sep 2021)

Pandemics involve irreversible risks and multiplicative effects, requiring proactive measures like quarantines and overactive testing, and effective communication to address misconceptions and encourage community involvement. Understanding the non-linearity of risks and integrating research into practice are key to improving pandemic management strategies.

Nassim Nicholas Taleb (Scholar Investor) - Wolfram Summer School 2021 (Jul 2021)

Economic and financial phenomena are complex and stochastic, requiring multidimensional and computationally irreducible models. Economic predictability is limited due to fat tails in distributions and the non-commutativity of averaging and applying functions.

Nassim Nicholas Taleb (Scholar Investor) - The Covid crisis is not a Black Swan (Jun 2021)

Nassim Taleb's theory of Mediocrestan and Extremistan categorizes phenomena into predictable and unpredictable domains, with extreme events in Extremistan having a significant impact. Connectivity accelerates winner-take-all effects and makes systems more susceptible to extreme events like the COVID-19 pandemic.

Nassim Nicholas Taleb (Scholar Investor) - Antifragility (Jun 2021)

Anti-fragility is the ability to benefit from shocks and stressors, rather than being harmed, and learning from errors and adapting to changing circumstances is key to building anti-fragility.

Nassim Nicholas Taleb (Scholar Investor) - Conversation with Yaneer Bar-Yam, Hosted by New England Complex Systems Institute (Apr 2021)

Early action and comprehensive public health strategies can mitigate both health and economic impacts of COVID-19, while fluctuating policies and delayed measures can have negative consequences on both fronts. Countries pursuing elimination strategies have achieved better outcomes compared to those with intermittent restrictions.

Nassim Nicholas Taleb (Scholar Investor) - India's Post-COVID Opportunity (Mar 2021)

Global connectivity and COVID-19 exposed economic disparities, cultural differences in pandemic responses, and the need for resilience and preparedness. India's "Atmanirbhar Bharat" emphasizes adaptability, economic flexibility, and domestic production to withstand future shocks.

Nassim Nicholas Taleb (Scholar Investor) - Interview with Massimo Sideri (Nov 2020)

Uncertainty is a defining element of human existence, but embracing it can lead to advantages and growth. Taleb's "Incerto" offers a unique perspective on uncertainty, combining scientific rigor and literary freedom to explore its complexities.

Nassim Nicholas Taleb (Scholar Investor) - Statistical consequences of fat tails | Amazon Consumer Science Summit (Oct 2020)

Fat tails, unlike thin tails, do not conform to the law of large numbers in the same manner, leading to slower convergence of sample statistics and challenging traditional statistical methods. Fat tails require specialized techniques and a paradigm shift in statistical thinking to accurately capture extreme events and make robust decisions.

Nassim Nicholas Taleb (Scholar Investor) - How to Price an Election (Oct 2020)

Forecasts should be evaluated in volatile scenarios using a probabilistic approach that considers skin in the game and consistent updating schemes. Uncertainty should lead to equally distributed probabilities, and tradable forecasts should incorporate volatility.

Nassim Nicholas Taleb (Scholar Investor) - Covid Misconceptions, Fed Policy, Inflation | Bloomberg (Sep 2020)

Nassim Taleb emphasized the need for resilience and prudent risk management during crises, advocating for tail-risk hedging and learning from history to prepare for future pandemics and global disruptions. He also criticized the US's COVID-19 response and the Federal Reserve's monetary policies, highlighting the importance of local production of essential goods and addressing supply chain fragilities.

Nassim Nicholas Taleb (Scholar Investor) - Covid Risk Conversation with Yaneer Bar-Yam (Sep 2020)

Pandemics require a shift from individual to collective risk assessment and evidence-based science to combat the uncertain dynamics and scale of contagion. Probabilistic approaches and appropriate reference models are crucial for effective decision-making and vaccination strategies.

Nassim Nicholas Taleb (Scholar Investor) - Antifragility and Skin in the Game (Sep 2020)

Nassim Nicholas Taleb's investment approach emphasizes preparedness for low-probability, high-impact events and embraces volatility. His barbell strategy balances low-risk stability with high-risk growth potential, while his emphasis on gold and dollars has shown success in turbulent economic times.

Nassim Nicholas Taleb (Scholar Investor) - On the Pandemic | EconTalk (Jul 2020)

Pandemics are fat-tailed events with unpredictable impacts, requiring early intervention and inexpensive risk mitigation measures like mask-wearing to protect both individuals and society. Traditional statistical methods may be inadequate for understanding pandemics, necessitating new frameworks like extreme value theory for better preparedness.

Nassim Nicholas Taleb (Scholar Investor) - Tail risk of contagious diseases (May 2020)

Statistical methodologies are essential for understanding and managing extreme events, and collaboration between various disciplines is crucial for comprehensive analysis. Robust analysis and consideration of extreme events in policy-making are necessary to effectively prepare for and manage these phenomena.

Nassim Nicholas Taleb (Scholar Investor) - Skin in the Game | Art of Manliness Podcast (Mar 2020)

Ethical decision-making involves considering the long-term consequences of actions and bearing the consequences of one's own choices, while rationality is often defined in terms of survival and can involve following instincts and rules that may seem irrational.

Nassim Nicholas Taleb (Scholar Investor) - Extreme events and how to live with them | Darwin College (Feb 2020)

Fat tails challenge conventional statistical methods, requiring specialized approaches for data analysis, risk assessment, and economic modeling. The prevalence of fat tails in real-world scenarios necessitates a paradigm shift in how we approach these areas.

Nassim Nicholas Taleb (Scholar Investor) - Current Lebanese Political and Economic Situation (Jan 2020)

Lebanon's economic crisis stems from unsustainable borrowing, patronage system, and banks' involvement, while Riyad Salameh advocates for subsidiarity, localism, and rejection of failed socialist policies to address these challenges.

Nassim Nicholas Taleb (Scholar Investor) - How India Can Achieve Anti-fragile Growth (Dec 2019)

Indian society has shifted from a passive mindset to a more active approach, embracing risk-taking and active participation for national progress. Practical experience and trial and error often lead to more effective results than solely relying on theoretical knowledge.

Nassim Nicholas Taleb (Scholar Investor) - Lebanon (Nov 2019)

Switzerland's stability stems from its local autonomy, diverse population, and avoidance of external conflicts, while Taleb advocates for localism and decentralization as antifragile governance models that promote individual freedom and adaptability.

Nassim Nicholas Taleb (Scholar Investor) - Studio Axess Idspecial (Nov 2019)

Asymmetry in human affairs refers to the imbalance between risk and reward, where one party bears the risks while another reaps the benefits. Ensuring personal accountability, sharing risks, and promoting transparency are vital for mitigating the adverse effects of asymmetry.

Nassim Nicholas Taleb (Scholar Investor) - Localism and its Application to Lebanon (Nov 2019)

Localism emphasizes individual control, voluntary agreements, and respect for diversity, while complex systems theory explores how interactions between agents lead to emergent properties and collective outcomes.

Nassim Nicholas Taleb (Scholar Investor) - Skin in the Game (Oct 2019)

Understanding risk, appearance, and craftsmanship in modern economics is crucial, as personal accountability and risk-taking shape financial decisions and passion and attention to detail create meaningful products.

Nassim Nicholas Taleb (Scholar Investor) - Skin in the Game | Talks at Google (Nov 2018)

Nassim Nicholas Taleb emphasizes personal accountability, challenges conventional wisdom on risk and uncertainty, and advocates for basing decisions on practical experience. Taleb criticizes pseudo-intellectuals, advocates for decentralized systems, and stresses the importance of skin in the game for acquiring valuable knowledge and making ethical decisions.

Nassim Nicholas Taleb (Scholar Investor) - Taleb and Ravikant chat at Blockcon 2018 (Oct 2018)

Taleb emphasizes the importance of practical experience over theoretical knowledge and advocates for aligning expertise with real-world accountability. He challenges conventional wisdom in fields like economics and emphasizes the value of risk-taking and skin in the game.

Nassim Nicholas Taleb (Scholar Investor) - Nassim Taleb Interviewed by Naval Ravikant (Full) (Oct 2018)

Real-world experience and risk-taking are essential for informed decision-making, while theoretical knowledge alone can be misleading. Minority groups can disproportionately influence societal norms and preferences.

Nassim Nicholas Taleb (Scholar Investor) - RPI's Media & War Conference (Sep 2018)

Nassim Nicholas Taleb's diverse pursuits encompass trading, academia, and engineering, marked by his unique philosophical outlook emphasizing personal accountability and responsibility. He critiques interventionists, the education system, and bureaucratic failures, advocating for skin in the game, commerce-driven peace, and the principle of charity in intellectual discourse.

Nassim Nicholas Taleb (Scholar Investor) - A Celebration of What Works | Likeville Podcast (Aug 2018)

Nassim Nicholas Taleb's work emphasizes the significance of personal accountability in decision-making, critiques modern Western society's trajectory, and explores the roles of religion, science, and tolerance in shaping societal dynamics.

Nassim Nicholas Taleb (Scholar Investor) - International Conference on Complex Systems (Jul 2018)

Considering fat tails, fragility, and the precautionary principle is crucial for effective risk management in domains like finance, health, and policy-making. Prioritizing survivability and acknowledging the limitations of traditional models enable informed, context-sensitive decisions in complex systems.

Nassim Nicholas Taleb (Scholar Investor) - 2018 Prime Quadrant Conference in Toronto (2018)

Risk management involves understanding fat tails, counterintuitive dynamics, and the importance of survival over short-term gains, while considering long-term consequences, absorbing barriers, and the influence of minorities.

Nassim Nicholas Taleb (Scholar Investor) - Interview with Gad Saad (Feb 2018)

Nassim Taleb emphasizes personal accountability and authenticity through the concept of "skin in the game," while critiquing contemporary social and scientific paradigms, urging reevaluation of risk, decision-making, and societal interactions.

Nassim Nicholas Taleb (Scholar Investor) - Bloomberg Interview (Oct 2017)

John Doe's trading journey showcased innovation, intensity, and insight within financial markets, particularly during the 1987 stock market crash, revealing flaws in traditional models and highlighting the need for robust risk management strategies.

Nassim Nicholas Taleb (Scholar Investor) - Problems with probability lecture at Rutgers (Sep 2017)

Fat tails, fragility, and ergodicity challenge traditional statistical models and risk management approaches, necessitating more robust methods to understand and manage risk in the face of extreme events. To address these challenges, multidisciplinary insights from finance, philosophy, and science are crucial for developing resilient systems and strategies that can withstand unpredictable occurrences.

Nassim Nicholas Taleb (Scholar Investor) - Black Swans and Interventionists (May 2017)

Taleb criticizes interventionist foreign policies and quantitative economic methods, advocating for more organic and libertarian approaches to managing global affairs and economies. He remains optimistic about the future, envisioning a libertarian world managed organically and where news are democratized through social media.

Nassim Nicholas Taleb (Scholar Investor) - India Today Conclave (Mar 2017)

Technological progress is unpredictable, and our complex systems are fragile, making us vulnerable to black swan events. Debt fragilizes society and corresponds with hubris, thus reducing debt can increase robustness.

Nassim Nicholas Taleb (Scholar Investor) - Interview with RT (2017)

Global challenges include conflicts, terrorism, economic disparities, and national identity issues. Complex issues such as the Syrian conflict, economic policies, and the significance of national identity were discussed.

Nassim Nicholas Taleb (Scholar Investor) - The dichotomy of behavioural economics | RiskMinds International (Dec 2016)

Simplicity is often more effective than complexity in uncertain decision-making environments, and experts' opinions should be critically evaluated.

Nassim Nicholas Taleb (Scholar Investor) - What it takes to be antifragile | Nutanix .NEXT 2016 Europe (Nov 2016)

Optionality enables flexibility, risk mitigation, and the exploration of opportunities, while anti-fragility allows systems to thrive in uncertain and volatile environments by benefiting from shocks and stressors.

Nassim Nicholas Taleb (Scholar Investor) - Antifragile (Sep 2016)

Fragile systems are vulnerable to harm under stress, while antifragile systems thrive on stressors and improve because of them. Understanding fragility and antifragility is crucial for navigating modern systems, from business to medicine, to achieve resilience and long-term success.

Nassim Nicholas Taleb (Scholar Investor) - Lebanon, of How systems Handle Disorder (Jun 2016)

Anti-fragility, the ability to thrive from disorder, contrasts with fragility, which leads to breakage under stress. Decentralization and frequent small crises promote resilience and stability in systems.

Nassim Nicholas Taleb (Scholar Investor) - Interview on Pandemics (2016)

Economic resilience comes from allowing small crises while managing larger ones; investment decisions should consider an entity's history of overcoming crises. Political structures must adapt to address global challenges effectively.

Nassim Nicholas Taleb (Scholar Investor) - Peace for Syria with Dr. Yaneer Bar-Yam (Oct 2015)

Complexity theory helps us understand interconnected global challenges, and a multiscale approach that respects ethnic boundaries and autonomy offers a robust solution to contemporary challenges.

Nassim Nicholas Taleb (Scholar Investor) - Chaire PARI confrence bercy (Oct 2015)

Traditional financial models are limited in capturing the complexity and unpredictability of real-world financial systems, necessitating a multidimensional approach that incorporates agent-based models and emphasizes skin in the game for effective risk management and decision-making.

Nassim Nicholas Taleb (Scholar Investor) - Interview with Bruce Oreck at Tomorrow Conference (Jun 2015)

Nassim Taleb emphasizes the importance of embracing risk, learning from failure, and fostering anti-fragility through decentralized governance, practical education, and diverse income sources. Taleb also highlights the value of sleep, walking, and social interactions for personal well-being and resilience.

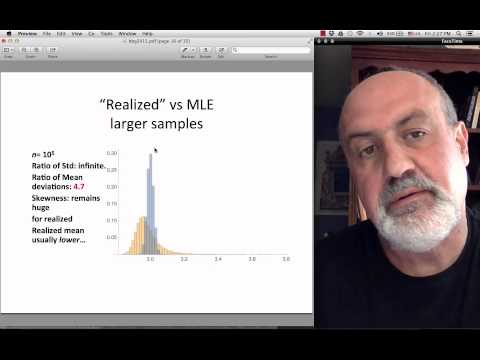

Nassim Nicholas Taleb (Scholar Investor) - The Law of Large Numbers and Fat Tailed Distributions (May 2015)

Fat-tailed distributions challenge traditional statistical methods, necessitating a paradigm shift in inference and inequality measurement. Traditional approaches fail in accurately estimating means, measuring inequality, and understanding extreme events in fat-tailed distributions.

Nassim Nicholas Taleb (Scholar Investor) - Wie können wir Krisen vorhersehen? (May 2015)

Nassim Taleb emphasizes anti-fragility, embracing uncertainty and building systems that thrive in disorder, and critiques centralized systems, advocating for decentralized ones to promote resilience and adaptability.

Nassim Nicholas Taleb (Scholar Investor) - Fletcher Political Risk Conference (Apr 2015)

Nassim Taleb challenges conventional data analytics for failing to account for extreme events and advocates for risk management strategies that consider the impact of fat tails. Traditional statistical methods struggle to capture fat-tailed distributions, leading to unreliable predictions and ineffective risk management.

Nassim Nicholas Taleb (Scholar Investor) - 2015 Fletcher Conference on Managing Political Risk (2015)

Nassim Taleb's insights question overreliance on data for predictions, emphasizing fragility and the influence of extreme events. He advocates for building robust systems that embrace unpredictability and ethical considerations in data analysis.

Nassim Nicholas Taleb (Scholar Investor) - The Precautionary Principle and Genetically Modified Organisms (Jan 2015)

Navigating risk, evidence, and decision-making requires a cautious approach, guided by the precautionary principle and understanding of statistical risk in fat-tailed domains. Technological advancements and systemic risks pose challenges that demand collective and informed decision-making.

Nassim Nicholas Taleb (Scholar Investor) - Small is Beautiful - But Also Less Fragile | NYU Urban Management (Dec 2014)

Fragility, vulnerability to harm from disorder, contrasts anti-fragility, which thrives on disorder and benefits from random events. Organic systems, like biological organisms, are anti-fragile, while engineered systems, like machines, are fragile.

Nassim Nicholas Taleb (Scholar Investor) - The 2008 financial crisis and the economy - The New Yorker Festival (Jul 2014)

Rare events, like the 2008 crisis, have a significant impact on financial markets, and the current financial system is fragile due to excessive debt and inadequate risk assessment models.

Nassim Nicholas Taleb (Scholar Investor) - How Things Handle Disorder | DLD Conference (Jan 2014)

Systems vary in their response to disorder, with some being fragile and suffering accelerating harm from stressors, while others are antifragile and benefit from uncertainty. Humans prefer natural scenes over artificial ones due to evolutionary familiarity and safety provided by natural environments.

Nassim Nicholas Taleb (Scholar Investor) - Discusses concept of Convexity and Antifragile at National Science Foundation (Oct 2013)

Rare events, non-linearity, and convexity are important factors to consider in risk management and decision-making. Anti-fragility, or the ability to benefit from volatility and uncertainty, is a key concept in understanding systems and making optimal decisions.

Nassim Nicholas Taleb (Scholar Investor) - Skin in the Game | EconTalk (Sep 2013)

The principle of "skin in the game" emphasizes personal accountability for decisions and actions, ensuring individuals bear the consequences of their choices. This concept underscores the importance of ethical decision-making and personal responsibility in various aspects of life, governance, and risk management.

Nassim Nicholas Taleb (Scholar Investor) - How to live in a world we don't understand (Apr 2013)

Nassim Nicholas Taleb's philosophies emphasize embracing variability, anti-fragility, and ethical decision-making to build resilient individuals and societies capable of thriving in uncertain times. His ideas challenge conventional wisdom and promote decentralized structures, accountability, and open dialogue.

Nassim Nicholas Taleb (Scholar Investor) - Stanford Seminar - Enntrepreneurial Thought Leaders (Apr 2013)

Optionality and trial and error are crucial for innovation and resilience in an uncertain world, while embracing anti-fragility and decentralization can help systems thrive in the face of stress and disorder.

Nassim Nicholas Taleb (Scholar Investor) - How Things Gain from Disorder | Stanford (Apr 2013)

Unpredictable rare events significantly impact finance, technology, and medicine, while antifragility thrives on volatility and randomness for growth. Decentralized systems exhibit greater stability due to the direct consequences of errors being felt by those who make them.

Nassim Nicholas Taleb (Scholar Investor) - Antifragile (2013)

Anti-fragility is the ability of systems to thrive and benefit from volatility, uncertainty, and stressors, rather than merely withstanding them. It challenges conventional wisdom by suggesting that we can create systems and societies that not only survive but also flourish in the face of unpredictable events.

Nassim Nicholas Taleb (Scholar Investor) - Nassim Taleb and Daniel Kahneman discusses Antifragility at NYPL (Feb 2013)

Taleb and Kahneman's theories explore uncertainty, decision-making, and the human psyche, emphasizing the limitations of predictive models and the value of heuristics and intuition in navigating complex situations. Antifragility, the ability of systems to benefit from stressors, is contrasted with fragility and robustness.

Nassim Nicholas Taleb (Scholar Investor) - Embracing Antifragility | Aljazeera Interview (Jan 2013)

Anti-fragility is the ability to thrive on disorder and benefit from stressors, while fragility leads to breakage under pressure. Embracing variability and stressors can build resilience and foster innovation in both personal and systemic contexts.

Nassim Nicholas Taleb (Scholar Investor) - Antifragille (Jan 2013)

Systems can be fragile, harmed by stressors, or antifragile, benefiting from volatility; measuring fragility and antifragility helps understand resilience and decision-making.

Nassim Nicholas Taleb (Scholar Investor) - Antifragile, Libertarianism, and Capitalism's Genius for Failure (Jan 2013)

Nassim Nicholas Taleb's concepts of fragility, robustness, and antifragility help comprehend and navigate an unpredictable world. His writings emphasize embracing antifragility through strategies like decentralization, low debt, and accepting mistakes.

Nassim Nicholas Taleb (Scholar Investor) - Remarks for Penguin Books UK (Nov 2012)

Anti-fragility describes systems and individuals that flourish under stress and disorder, while embracing randomness can lead to resilience and growth in various areas of life.

Nassim Nicholas Taleb (Scholar Investor) - "The Black Swan (Sep 2012)

Complex systems are increasingly fragile due to over-optimization, leverage, and globalization, making them vulnerable to catastrophic black swan events. Societies should strive for robustness by prioritizing resilience, accountability, and simplicity.

Nassim Nicholas Taleb (Scholar Investor) - Probability and Outcome (Sep 2012)

Nassim Nicholas Taleb's work explores randomness, probability, and complexity, emphasizing the importance of interdisciplinary thinking and cautioning against over-specialization in an increasingly uncertain world. Taleb's insights challenge our understanding of randomness, luck, and the inherent unpredictability of life.

Nassim Nicholas Taleb (Scholar Investor) - The Black Swan | Princeton (Apr 2012)

Fragility is the susceptibility to harm from disorder or stress, while antifragility is thriving and growing stronger from disorder or stress. The triad of fragility, robustness, and antifragility can aid decision-making in a complex and uncertain world.

Nassim Nicholas Taleb (Scholar Investor) - Antifragility | EconTalk (Jan 2012)

Nassim Taleb's concept of anti-fragility describes systems that thrive under stress and uncertainty, challenging conventional risk assessment and advocating for resilience and adaptability. Anti-fragility emphasizes the benefits of controlled stress and embraces volatility to build robust systems capable of withstanding unforeseen events and nonlinearities.

Nassim Nicholas Taleb (Scholar Investor) - Black Swans, Fragility, and Mistakes | EconTalk (May 2010)

Nassim Taleb emphasizes the importance of redundancy and skepticism in forecasting and financial systems while advocating for learning from historical mistakes and embracing natural processes. Taleb's insights challenge conventional wisdom and promote resilience in the face of complexity and uncertainty.

Nassim Nicholas Taleb (Scholar Investor) - David Cameron in conversation with Nassim Taleb (Feb 2010)

Over-specialization and excessive debt make economic systems fragile and vulnerable to black swan events, while Mother Nature's lessons of resilience and redundancy can inspire more robust economic structures.

Nassim Nicholas Taleb (Scholar Investor) - Intelligent Design Debate (2009)

Religion and science have differing truth claims and approaches to understanding reality, leading to conflicts in beliefs and interpretations. Morality can exist independently of religious beliefs, with proponents advocating for secular morality based on reason, empathy, and shared human values.

Nassim Nicholas Taleb (Scholar Investor) - The Economic Crisis and Its Implications for the Science of Economics (2009)

Fat tails challenge traditional statistical methods and require a focus on simple payoffs and practical strategies that enhance resilience and survival in an uncertain economic world.

Nassim Nicholas Taleb (Scholar Investor) - On Black Swans | EconTalk (Apr 2007)

Nassim Taleb's theories explore the influence of extreme events in decision-making and the limitations of linear models in understanding complex systems characterized by randomness and uncertainty. He emphasizes the significance of acknowledging our ignorance and embracing the unknown to navigate complex environments effectively.

Nassim Nicholas Taleb (Scholar Investor) - PopTech Conference (Oct 2005)

Forecasting is limited by the scope of our knowledge, the unpredictability of black swan events, and the tendency to overestimate our expertise. The complexity of the world, particularly in social sciences, often exceeds our modeling capabilities, making accurate predictions challenging.

Nassim Nicholas Taleb (Scholar Investor) - Harold Channer Interview (Dec 2001)

Nassim Taleb's insights on randomness, probability, and decision-making offer a unique perspective on comprehending our increasingly complex world, urging acceptance of uncertainty and appreciation of the interplay between order and chaos. Taleb emphasizes the limitations of human understanding and advocates for holistic thinking in a specialized world.